1. Evaluate Your Finances. Buying a second home means double the financial burden, but savvy financing can help to save you money in the long run. Whether you use a HELOC, a conventional loan, or buy with cash, you can expect higher interest rates, increased down payments, and more stringent income requirements.. Rental income counts as regular income, which means you need to report it to the IRS and pay taxes on it. If you can charge $1,500 per month to rent your house and expect to collect $18,000 in rent over a year, you need to deduct your taxes on that income before you start calculating your total rental profits.

Buying a Second Home and Renting Out the First in Canada Pros and Cons 2023 Guide FotoLog

Buying a Second Property to Rent Out How it Works in 2023

Cost of Renting vs Buying a Home

Buying a Second Home & Renting Out the First Mortgage Okanagan

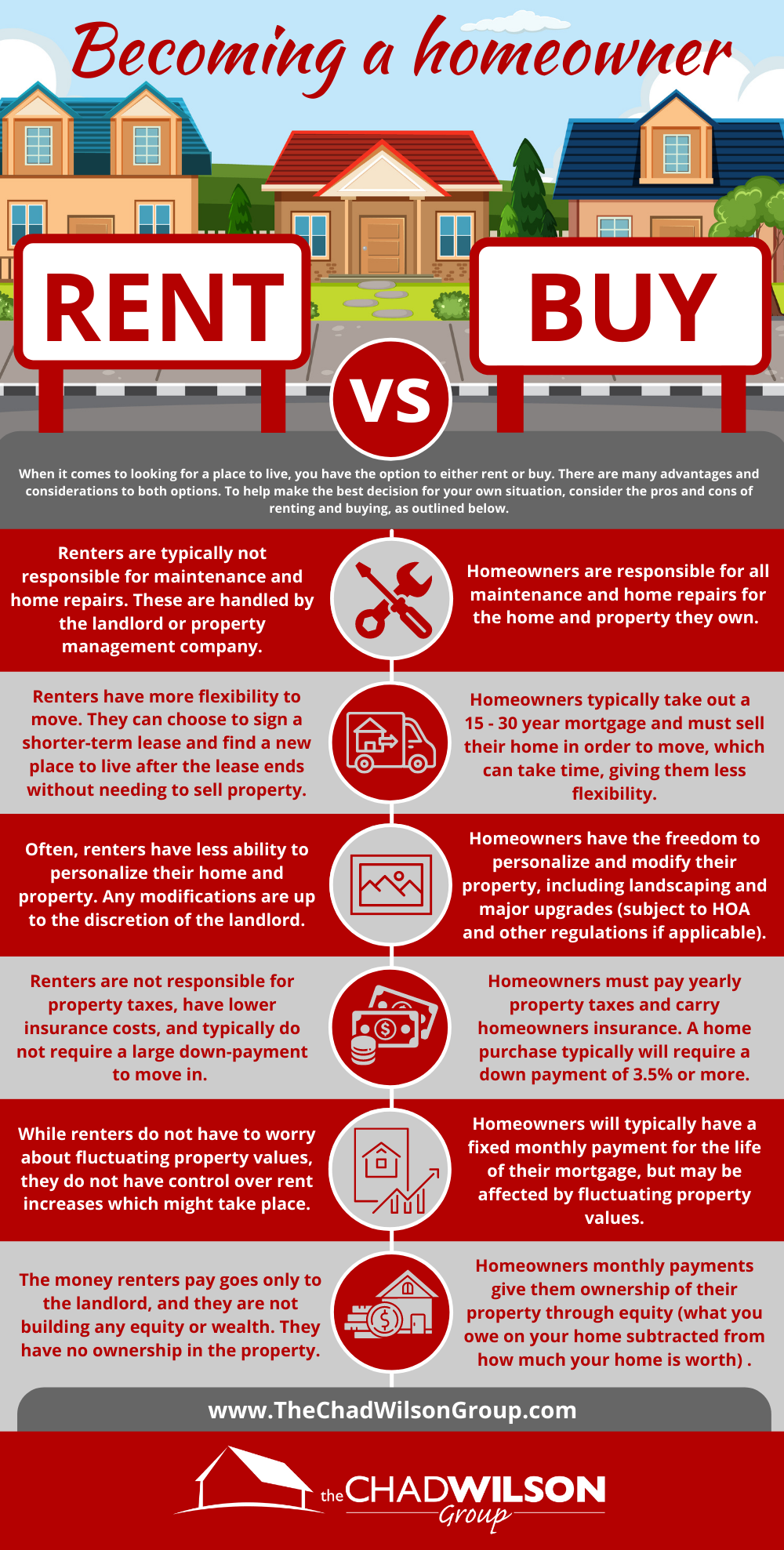

The Pros & Cons of Renting Versus Buying a Home

Should I rent or buy a home? Armstrong Advisory Group

Renting vs Owning a Home Which is Better? Vermont Real Estate & Home Services

How to afford a second home? — Good Living CT

Buying a Second Home and Renting Out the First in Canada

Renting In Canada All You Need to Know Lionsgate Financial Group

Buying, Renting, and Selling a Second Home Charles Schwab

Renting vs Buying a Home Which is Right for You?

Renting Out a Second Home Wheeler Accountants, LLP

Rent out a House PPHAW Real Estate Amsterdam

What you need to Know before Buying a Second Home Locations North

Renting vs. Buying Home in Canada Which is better? GetNewHouse

Buying a Second Home & Renting Out the First Mortgage Okanagan

Renting Out Houses Is A Great Way To Make Money RadioUnuManele

Buying a Second Home and Renting Out the First YouTube

![The Cost of Renting Vs. Buying a Home [INFOGRAPHIC] Sarasota Global Realty The Cost of Renting Vs. Buying a Home [INFOGRAPHIC] Sarasota Global Realty](https://sarasotaglobalrealty.com/wp-content/uploads/2020/08/20200828-MEM-scaled-1.jpg)

The Cost of Renting Vs. Buying a Home [INFOGRAPHIC] Sarasota Global Realty

When buying a home, the down payment rules in Canada are as follows: Purchase price. Minimum down payment required. $500,000 or less. 5% of the purchase price. $500,000 to $999,999. 5% of the.. 5 steps to buy a second home and rent the first. While there are several benefits to renting the first home out, having two homes is something to think carefully about. Here are 5 basic steps to follow to buy a second home and rent the first one out. 1. Assess your financial situation.